Text

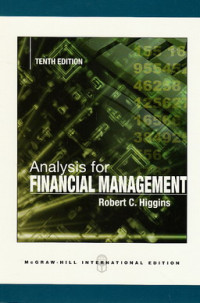

Analysis for financial manadement

Like its predecessors, the tenth edition of Analysis for Financial Manage¬ment is for nonfinancial executives and business students interested in the practice of financial management. It introduces standard techniques and recent advances in a practical, intuitive way. The book assumes no prior background beyond a rudimentary, and perhaps rusty, familiarity with financial statements—although a healthy curiosity about what makes business tick is also useful. Emphasis throughout is on the managerial im¬plications of financial analysis.

Analysis for Financial Management should prove valuable to individuals interested in sharpening their managerial skills and to executive program participants. The book has also found a home in university classrooms as the sole text in Executive MBA and applied finance courses, as a compan¬ion text in case-oriented courses, and as a supplementary reading in more theoretical finance courses.

Analysis for Financial Management is my attempt to translate into an¬other medium the enjoyment and stimulation I have received over the past three decades working with executives and college students. This ex¬perience has convinced me that financial techniques and concepts need not be abstract or obtuse; that recent advances in the field such as agency theory, market signaling, market efficiency, capital asset pricing, and real options analysis are important to practitioners; and that finance has much to say about the broader aspects of company management. I also believe that any activity in which so much money changes hands so quickly can¬not fail to be interesting.

Part One looks at the management of existing resources, including the use of financial statements and ratio analysis to assess a company's finan¬cial health, its strengths, weaknesses, recent performance, and future prospects. Emphasis throughout is on the ties between a company's oper¬ating activities and its financial performance. A recurring theme is that a business must be viewed as an integrated whole and that effective financial management is possible only within the context of a company's broader operating characteristics and strategies.

The rest of the book deals with the acquisition and management of new resources. Part Two examines financial forecasting and planning with par¬ticular emphasis on managing growth and decline. Part Three considers the financing of company operations, including a review of the principal security types, the markets in which they trade, and the proper choice of

Ketersediaan

Informasi Detail

- Judul Seri

-

-

- No. Panggil

-

658.15 Hig a

- Penerbit

- New York : Mc Graw-Hill., 2012

- Deskripsi Fisik

-

xvi, 460 hal. : il. ; 23 cm.

- Bahasa

-

English

- ISBN/ISSN

-

9780071086486

- Klasifikasi

-

658.15

- Tipe Isi

-

-

- Tipe Media

-

-

- Tipe Pembawa

-

-

- Edisi

-

Ed. X

- Subjek

- Info Detail Spesifik

-

-

- Pernyataan Tanggungjawab

-

-

Versi lain/terkait

Tidak tersedia versi lain

Lampiran Berkas

Komentar

Anda harus masuk sebelum memberikan komentar

Karya Umum

Karya Umum  Filsafat

Filsafat  Agama

Agama  Ilmu-ilmu Sosial

Ilmu-ilmu Sosial  Bahasa

Bahasa  Ilmu-ilmu Murni

Ilmu-ilmu Murni  Ilmu-ilmu Terapan

Ilmu-ilmu Terapan  Kesenian, Hiburan, dan Olahraga

Kesenian, Hiburan, dan Olahraga  Kesusastraan

Kesusastraan  Geografi dan Sejarah

Geografi dan Sejarah